Non-Dilutive Capital, Structured to Meet the Needs of Your Business

We Design, Structure and Manage Non-Dilutive Capital Solutions Across the Full Growth Cycle

Who We Are

Beltline Capital Partners is a Canadian investment firm focused on providing flexible, non dilutive capital to small and mid sized businesses. We invest at moments of growth, transition, or complexity where traditional lenders are constrained and equity is either unavailable or misaligned. Working alongside a network of private and institutional capital partners, we structure tailored credit solutions that preserve ownership and support long term execution.

What We Do

We are capital architects

Most businesses are not simply looking for a loan. They need a capital structure aligned with the decision they are facing. Speed, flexibility, cost, and control all matter, but not always at the same time.

Beltline Capital Partners works between operating businesses and institutional capital to evaluate situations, structure appropriate capital solutions, and support companies as their needs change over time.

How our process works

We begin with a capital assessment and underwriting review, not a product pitch. From there, we help design the appropriate capital structure and manage execution alongside aligned capital partners.

Our involvement continues beyond closing. We remain engaged to oversee structure, performance, and capital evolution as the business grows or conditions change.

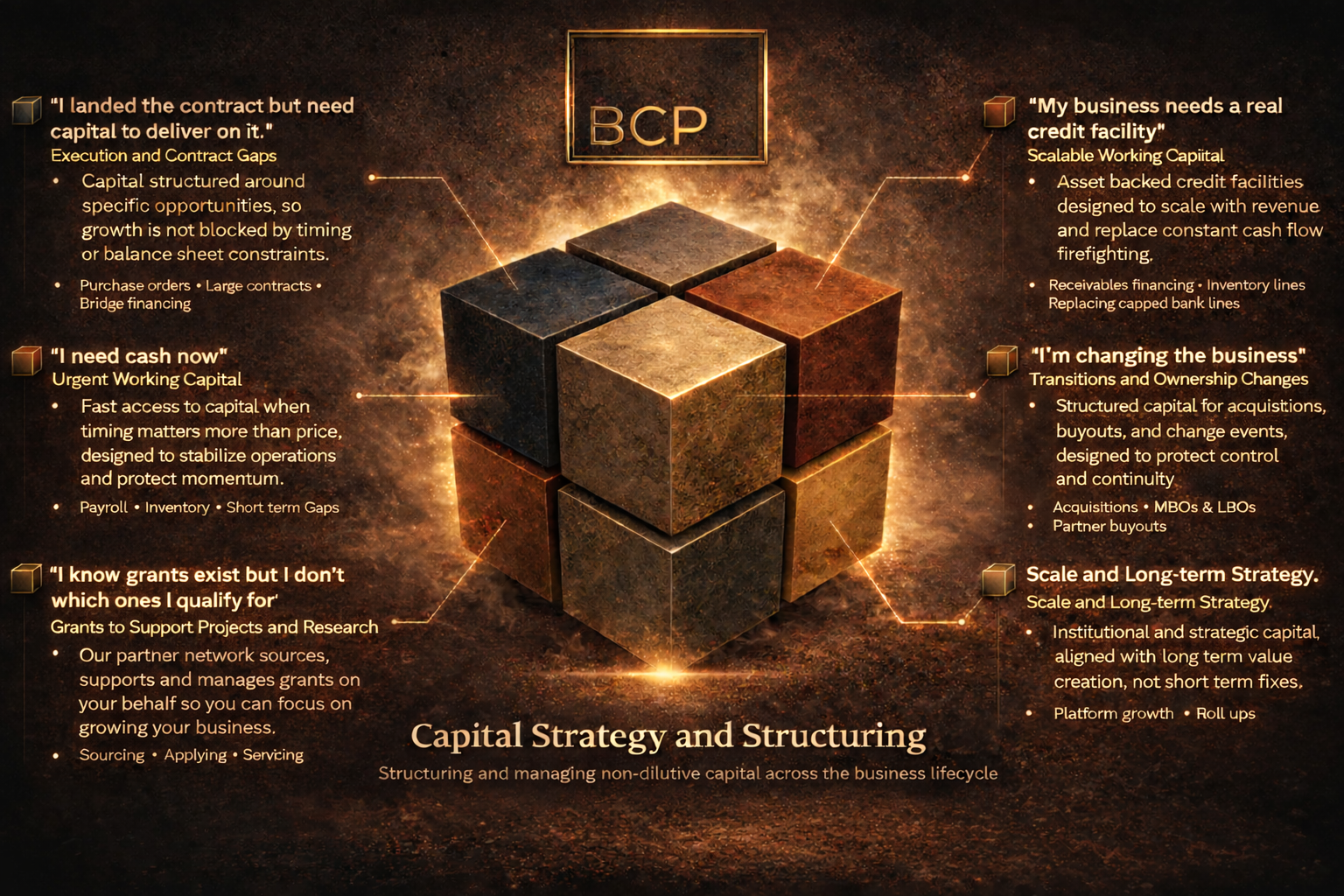

Problems We Help Solve

Our Capital Solutions

From fast working capital to institutional strategic credit solutions.

-

Fast Capital Under $250k

This solution is designed for businesses that need capital quickly and cannot afford long approval cycles. We work with national funding partners that provide fast access to working capital with minimal friction.

-

Special Situations Credit

This solution is for companies facing situations that do not fit standard lending models. That may include rapid growth, operational transitions, special situations, or capital needs where conventional lenders have declined.

-

Scalable Facilities and Term Loans

This solution provides flexible, asset backed capital for established operating companies with stable revenues that fall outside traditional bank lending models. These are often high quality businesses navigating growth, complexity, or balance sheet needs where standard underwriting frameworks fail to capture true operating strength and opportunity.